Land Transfer Taxes

In many provinces, a land transfer tax is assessed on real property when ownership of the property is transferred from one person to another. The tax is a percentage of the value of the property, based on a sliding scale.

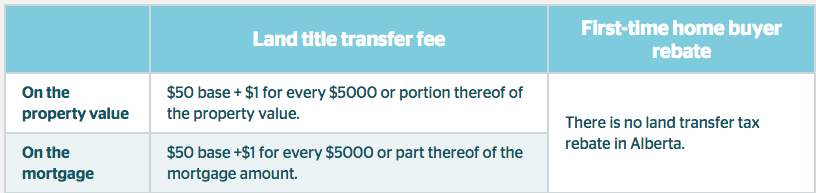

In Alberta, we don’t have a land transfer tax; instead, we are assessed a fee, based on the value of the home using the formula seen below. Alberta’s provincial fees are much lower than the taxes in other provinces.

In order to understand this better, here is an example of how the calculation is done to assess the fee which will be charged for the land transfer. Each land transfer has two calculations applied to it in order to determine the fee amount. One calculation is applied based on the value of the home and the other calculation is applied, based on the value of the amount being mortgaged.

The image below depicts those calculations based on a property value of $202,500 and making a 20% downpayment.

To begin with, the property value of $202,500 is divided by $5000; this equates to 41 portions of value. Everyone must be assessed a $50 base fee, and then a $1fee per $5000 of home value is assessed on top of that. So, the portion of the fee assessed based on property value is $91.

The second part of the calculation is based on the value of the mortgage. In the example below, the value of the mortgage, which is $162,000 is divided by $5000 to determine that there are 33 portions of value. Again, on this portion of the assessment of fees, everyone is charged a base amount of $50 and then an additional $1 fee for every $5000 of mortgage value. In this scenario then, we are assessed with a property value fee of $83.

The total Land Transfer Fee in this example then, when adding together the assessment fees for both the value of the home and the value of the mortgage, would amount to a total of $174 land transfer tax in Alberta.

Many provinces offer a rebate of Land Transfer Taxes. In Alberta, this is not the case. The province has provided a more economical fee schedule rate to home purchasers than other provinces and therefore does not offer a rebate. Please note that the rate specified in this article was in effect as of 2013.

In an effort to make comparisons between the provinces’ Land Transfer Tax rates, the CCH provided the following provincial comparisons based on a $200,000 home and had the following to say:

Land or Property Transfer Tax

—Peter Tomlinson, CCH Canadian Limited

On June 1, 2012, New Brunswick increased its land transfer tax rate from 0.25% to 0.5%. In light of that recent change, this seems like a good time for a basic review of the various land transfer taxes and fees in effect in the provinces and territories.Ontario, Quebec, British Columbia, Manitoba, Nova Scotia, New Brunswick, and Prince Edward Island levy a land transfer tax, or property transfer tax, applicable on the purchase and sale of real property, payable when the transfer is registered. In Quebec, this is referred to as “duties on the transfer of immovables”. Although the remaining provinces and territories do not technically levy a land transfer tax, they do charge registration fees based on the value of the property being transferred. These fees, which can be significant in some cases, are sometimes informally referred to as land transfer tax, but the rates are generally less than the land transfer taxes applicable in the other jurisdictions.In certain jurisdictions, there may be additional land transfer taxes imposed by individual municipalities. Except for Nova Scotia, where the rates are set by individual municipalities, and the land transfer tax imposed by the City of Toronto, this article will focus on taxes and fees imposed by a province or territory.

Example of Taxes and Fees

To provide a brief comparison of the various rates across jurisdictions, it is useful to consider an example. The following taxes or fees apply to the purchase of a $200,000 property located in the province or territory specified below:

- Nova Scotia—$0 to $3,000 (depending on the municipality)

- British Columbia—$2,000

- Prince Edward Island—$2,000

- Quebec—$1,750

- Ontario—$1,725 (plus an additional $1,725 municipal tax if the property is located in Toronto)

- Manitoba—$1,650

- New Brunswick—$1,000

- Newfoundland and Labrador—$898 (plus a similar amount to register a mortgage)

- Saskatchewan—$600

- Northwest Territories—$300

- Nunavut—$300

- Alberta—$90

- Yukon—$73

As you can see by the article above, it stands to reason that Alberta would not offer a rebate of the Land Transfer Fees in light of the fact that the province has one of the lowest rates across Canada. There are other provinces which also don’t tax the land transfers, however, Alberta has one of the most reasonable fee rates in the country.

Images courtesy of //www.ratehub.ca/land-transfer-tax-alberta

Excerpt by Peter Tomlinson, CCH Canadian Limited may be found at //www.cch.ca/newsletters/TaxAccounting/October2012/article2.htm